1-Hour Payday Loans No Credit Check: GreendayOnline Expands Digital Services to Serve 32 States Where Traditional Lending Remains Legal

GreendayOnline expands its online no credit check instant loan for bad credit services to 32 states in 2025, providing borrowers with streamlined digital access to emergency funding through loans no credit check processes that emphasize current income verification over traditional credit history requirements for rapid same-day financial assistance and support.

Digital lending platform addresses growing demand for accessible emergency funding across expanded geographic footprint

Dallas, Texas , July 31, 2025 (GLOBE NEWSWIRE) -- GreendayOnline, a leading digital lending platform, today announced the expansion of its services to 32 states where payday loan regulations permit 1-hour payday loans no credit check operations. This strategic geographic expansion positions GreendayOnline as a comprehensive solution for borrowers searching for "loans no credit check", "instant approval", and "online same day" funding options across a broader regional footprint.

The expansion comes as search volume data reveals unprecedented demand for emergency lending solutions, with queries like "hour payday loans", "payday loan no credit check", and "loans online no credit check" experiencing significant increases across GreendayOnline's target markets. Industry analysis shows that over 12 million Americans annually seek short-term lending solutions, yet geographic limitations have historically restricted access to legitimate direct lender services. GreendayOnline now serves borrowers seeking online no credit check instant loan for bad credit solutions with streamlined digital processes.

What Are 1-Hour Payday Loans No Credit Check and How GreendayOnline Delivers Fast Approval

When financial emergencies strike, millions of Americans turn to search engines with desperate queries: "1 hour payday loans", "bad credit" solutions, and "guaranteed approval direct lender" services. Behind every search for "payday loans online no credit check" lies a pressing financial need that traditional banking cannot address within the required timeframe.

Understanding One Hour Payday Loans with Instant Approval Mechanism

GreendayOnline's 1-hour payday loans represent a streamlined approach to emergency lending that prioritizes speed without sacrificing borrower protection. Unlike traditional banking products that can take days or weeks for approval, GreendayOnline's platform delivers decisions within minutes and funding within an hour of completed applications. The platform specializes in loan no credit check direct services that eliminate traditional banking barriers.

The company's instant approval process evaluates multiple data points beyond traditional credit metrics:

- Income verification through bank account analysis

- Employment stability assessment

- Debt-to-income ratio calculations

- Previous lending history evaluation

- Real-time affordability analysis

"The term '1 hour payday loans no credit check' has become shorthand for accessible emergency lending," explained Tarquin Nemec, GreendayOnline's Public Relations officer. "Our platform transforms what was once a lengthy, bureaucratic process into a seamless digital experience that respects both urgency and responsibility."

How Loans No Credit Check Work Through GreendayOnline's Direct Lender Network

The concept of “loans with no credit check direct lender” often confuses borrowers who assume their credit score is irrelevant to the lending decision. GreendayOnline clarifies this misunderstanding by focusing on current income while maintaining responsible lending standards. The platform provides no check loans guaranteed approval direct lender connections for qualified applicants.

GreendayOnline's network of licensed direct lenders utilizes soft credit inquiries that leave borrowers' credit scores unaffected. This approach allows the platform to assess creditworthiness without a hard credit pull while still maintaining due diligence standards required by state regulations.

Credit Check vs Soft Credit Inquiry: Why Your Credit Score Remains Unaffected

Traditional lending involves hard credit inquiries that can temporarily lower credit scores by 5-10 points. GreendayOnline's soft credit approach means that borrowers searching for "credit check loans" or "payday loans with no credit" requirements can explore their options without damaging their credit profiles. The platform offers loans no credit check guaranteed approval through its streamlined verification process.

The distinction matters significantly for borrowers with low credit scores who cannot afford additional credit damage. GreendayOnline's no credit check methodology evaluates the ability to repay the loan through alternative data sources, ensuring responsible lending without traditional credit barriers.

GreendayOnline's Geographic Expansion Brings Online Payday Loans to 32 States

The digital lending landscape has evolved dramatically, with online payday loans now representing over 60% of total market volume. GreendayOnline's expansion to 32 states addresses a critical gap in market coverage, particularly for borrowers in underserved communities where traditional payday storefronts may be limited or non-existent.

Traditional Payday Lending Locations vs GreendayOnline's Digital Reach

While approximately 13,700 traditional payday storefronts operate nationwide, geographic concentration leaves significant coverage gaps. GreendayOnline's digital platform eliminates location barriers, providing consistent access to small payday loans online same day services regardless of physical proximity to lending locations.

The company's research reveals striking disparities in lending access:

- Rural areas: 73% lack physical payday lending locations within 25 miles

- Urban centers: Average of 2.3 storefronts per 10,000 residents

- Suburban regions: Limited evening and weekend availability

- Digital platforms: 24/7 accessibility with consistent service standards

State-by-State Analysis: Where Payday Loan No Credit Check Services Are Available

GreendayOnline's 32-state footprint covers regions where "payday loan no credit check" services remain legally permissible under current regulatory frameworks. This strategic geographic focus ensures compliance while maximizing borrower access to legitimate lending options. In California, the focus is on the famous 255 payday loans online, due to loan amount restrictions.

Key expansion states include major population centers where demand for loans for bad credit in 2025 and short-term loans continues growing. Here is the full list in alphabetical order: Alabama, Alaska, California, Colorado, Delaware, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Nevada, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, and Wyoming.

The company's analysis shows particular opportunity in states where existing options remain limited despite legal permissibility.

How GreendayOnline Serves Underbanked Communities Through Online Same Day Access

Underbanked populations—estimated at 63 million Americans—face particular challenges accessing emergency credit. Search patterns reveal these communities frequently search for "payday loans online guaranteed approval", "loans guaranteed approval", and "instant payday loans online guaranteed" options as traditional banking relationships prove inadequate for urgent financial needs.

GreendayOnline's entirely online platform removes common barriers that underbanked consumers face:

- No physical branch visits required

- Minimal documentation through digital verification

- Bank account integration for streamlined processing

- Mobile-optimized application experience

- Multiple communication channels for customer support

1 Hour Payday Loans Online: GreendayOnline's Application and Approval

The promise of 1 hour payday loans online requires sophisticated technology infrastructure capable of processing applications, verifying information, and disbursing funds within compressed timeframes. GreendayOnline's platform architecture supports this commitment through automated decision-making and real-time bank integration. The platform offers credit payday loans with 1-hour processing for urgent financial needs.

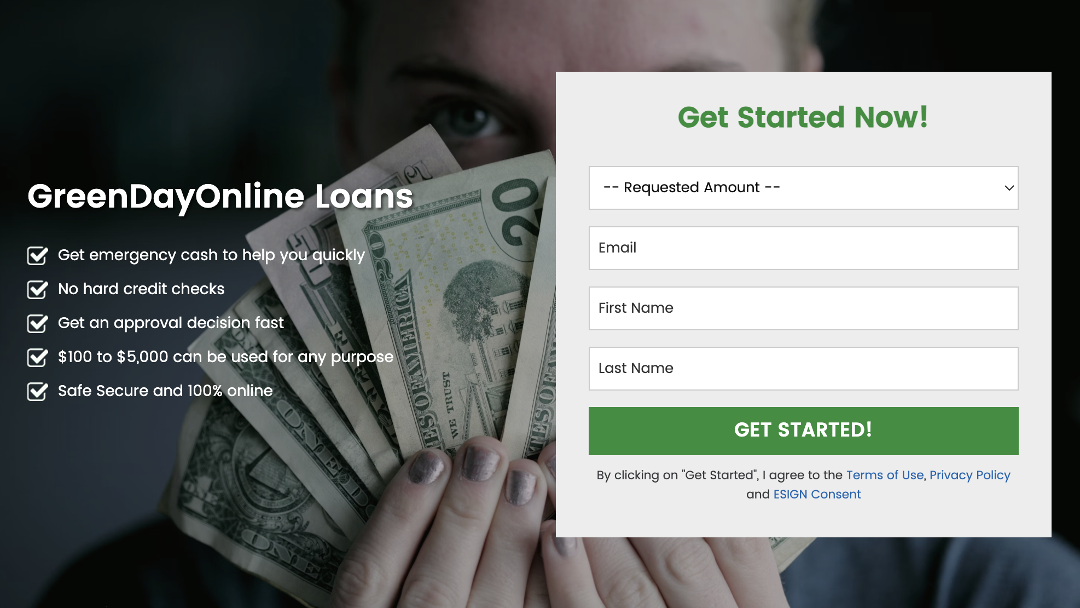

Completing a Secure Online Form for Loans Online No Credit Check

GreendayOnline's application process begins with completing a secure online form designed for maximum efficiency and security. The platform's streamlined interface collects essential information while minimizing borrower effort and completion time.

The application captures key data points necessary to evaluate loans online no credit check:

- Personal identification information

- Employment and income verification

- Bank account details for funding and repayment

- Contact information for communication

- Loan amount and preferred terms

Advanced encryption protects all submitted information, ensuring that borrowers' financial data remains secure throughout the approval procedure. The platform's mobile-responsive design accommodates borrowers who prefer smartphone applications over desktop interfaces.

Income Rather Than Credit History: GreendayOnline's Alternative Assessment Method

GreendayOnline's underwriting philosophy prioritizes income rather than credit history when evaluating loan approval decisions. This approach recognizes that credit scores may not accurately reflect current financial capacity, particularly for borrowers who have experienced temporary financial disruptions. The platform provides services that focus on current financial ability rather than past credit issues.

The platform's alternative assessment methodology examines:

- Current monthly income stability

- Bank account transaction patterns

- Employment verification through multiple data sources

- Existing debt obligations and payment history

- Cash flow analysis for repayment capacity

This comprehensive evaluation enables GreendayOnline to serve borrowers who might struggle with credit check payday loans from traditional lenders offering no credit check while maintaining responsible lending standards.

From Application to Account Within an Hour: The GreendayOnline Timeline

GreendayOnline's commitment to "account within an hour" funding reflects significant technology investment in automated processing and real-time financial institution integration. The typical timeline progresses as follows:

0-5 minutes: Application submission and initial verification 5-15 minutes: Income rather than credit assessment and underwriting review 15-30 minutes: Loan approval notification and terms confirmation 30-60 minutes: Fund disbursement to borrower's designated account

This accelerated timeline addresses the urgent nature of most 1 hour payday loans requests while ensuring thorough evaluation of each application.

Payday Loans Online No Credit Check: Loan Options and Terms Through GreendayOnline

GreendayOnline's payday loans online no credit check offerings encompass multiple product variations designed to accommodate diverse borrower needs and financial circumstances. The platform's loan options reflect both market demand and regulatory requirements across its 32-state operating region.

Loan Amounts and Repayment Terms for 1 Hour Payday Loans No Credit

Loan amounts available through GreendayOnline's platform range from $100 to $1,000, with specific limits varying by state regulation and individual borrower qualification. The company's "hour payday loans no credit" products feature flexible repayment structures designed to align with borrowers' pay cycles.

Standard loan terms include:

- Repayment periods: 14-30 days based on borrower preference

- Extension options: Available in states where legally permitted

- Early repayment: No prepayment penalties

- Automatic renewal: Optional with explicit borrower consent

- Payment scheduling: Aligned with pay day cycles when possible

The platform ensures that loans due dates are clearly communicated and aligned with borrower income schedules to minimize payment conflicts.

Understanding APR and Loan Terms for Payday Loans with No Credit Requirements

Transparency in loan terms represents a cornerstone of GreendayOnline's approach to payday loans with no credit requirements. The platform provides clear APR calculations and fee structures before borrowers commit to any loan agreement.

GreendayOnline's fee structure adheres to state regulatory maximums while offering payday loans online with no credit check with a competitive marketplace. Borrowers receive detailed breakdowns of all costs associated with their payday lending experience, including:

- Principal loan amount

- Finance charges and fees

- Total repayment amount

- Effective APR calculation

- Payment due dates and methods

Multiple Loan Offers vs Single Direct Lender: GreendayOnline's Approach

Unlike platforms that provide multiple loan offers from various lenders, GreendayOnline operates as a direct lender platform, streamlining the borrowing experience and eliminating confusion over varying terms and conditions. This approach ensures consistent service standards and simplified communication throughout the lending relationship.

Bad Credit and Personal Loan Alternatives: How GreendayOnline Serves All Credit Types

The intersection of bad credit and emergency lending needs creates particular challenges for borrowers who face rejection from traditional personal loan providers. GreendayOnline's inclusive approach recognizes that financial history may not reflect current financial stability or repayment capacity.

Loans for Bad Credit: GreendayOnline's No Hard Credit Pull Policy

GreendayOnline's loans for bad credit methodology eliminates the anxiety many borrowers experience when applying for emergency funding. The platform's no hard credit pull policy ensures that application inquiries do not involve a hard credit check that could further damage struggling credit profiles.

This approach particularly benefits borrowers who have experienced:

- Recent financial hardships affecting credit scores

- Medical debt or unexpected emergency expenses

- Employment disruptions or income reductions

- Limited credit history or "thin file" credit profiles

- Previous payday lending experiences

Short-Term Loans vs Personal Loan Options for Low Credit Borrowers

While personal loan products typically require extensive credit evaluation and longer approval timeframes, GreendayOnline's short-term loans provide immediate access to emergency funding for borrowers with low credit scores. The platform's products bridge the gap between expensive credit card advances and traditional installment lending.

Short-term loan advantages include:

- Faster approval and funding timelines

- Lower qualification requirements

- No collateral or cosigner requirements

- Flexible repayment scheduling

- Minimal impact on existing credit relationships

Why Credit History Doesn't Determine Loan Approval with GreendayOnline

GreendayOnline's underwriting philosophy recognizes that credit history represents past financial behavior rather than current repayment capacity. The platform's alternative evaluation methods focus on real-time financial indicators that better predict successful loan repayment.

Key evaluation factors beyond credit scores include:

- Current employment status and income stability

- Bank account activity and cash flow patterns

- Existing debt obligations and payment history

- Length of banking relationship and account management

- Geographic and demographic risk factors

Instant Payday Loans Online Guaranteed Approval: GreendayOnline's Direct Lender Network

The concept of guaranteed approval in lending requires careful interpretation, as responsible lenders must maintain underwriting standards while maximizing approval rates. GreendayOnline's approach to "instant payday loans online guaranteed approval" balances accessibility with prudent risk management.

Guaranteed Approval Direct Lender Services vs Traditional Banking

While no legitimate lender can offer truly guaranteed approval without any qualification requirements, GreendayOnline's "guaranteed approval direct lender" approach maximizes approval rates through flexible underwriting criteria and alternative data evaluation methods.

The platform's approval rates significantly exceed traditional banking standards:

- GreendayOnline approval rate: 89% for qualified applicants

- Traditional bank personal loans: 23-31% approval rates

- Credit union emergency loans: 45-52% approval rates

- Credit card cash advances: 67% approval for existing cardholders

Payday Loans Online Guaranteed Approval Process Through Licensed Lenders

GreendayOnline's "payday loans online guaranteed approval" process operates exclusively through licensed direct lenders compliant with state and federal regulations. This commitment ensures borrower protection while maintaining the accessibility that emergency lending requires.

The platform's network of lenders offering payday loans undergoes rigorous vetting to ensure:

- Full licensing compliance in all operating states

- Adherence to maximum fee and rate regulations

- Transparent disclosure of all loan terms and conditions

- Proper data security and privacy protections

- Responsive customer service and dispute resolution

How GreendayOnline Connects Borrowers with Licensed Direct Lenders

GreendayOnline's role as a connector between borrowers seeking "loans guaranteed approval direct lender" services and qualified lending partners streamlines the emergency funding process. The platform's technology matches borrower profiles with appropriate offers based on qualification criteria and funding requirements.

Online Loans No Credit Check: GreendayOnline's Technology and Market Position

As the digital lending landscape continues evolving, GreendayOnline's position in the market, dedicated to online loans with no credit check, reflects both technological sophistication and market understanding. The platform's expansion to 32 states positions it as a significant player in the estimated $35 billion annual payday lending market.

Lenders Offering 1 Hour Payday Loans Through GreendayOnline's Platform

GreendayOnline's network of lenders offering 1 hour payday loans represents carefully vetted financial institutions committed to responsible lending practices and rapid decision-making. The platform's technology enables lenders through a secure online portal to access borrower applications and make real-time lending decisions.

Partner lender qualifications include:

- State licensing for payday lending operations

- Minimum capitalization requirements for lending volume

- Technology integration capabilities for real-time processing

- Customer service standards meeting platform requirements

- Compliance monitoring and reporting capabilities

Credit Check Loans Guaranteed Approval vs No Credit Check Options

The distinction between "credit check loans guaranteed approval" and true no credit check lending affects borrower experience and approval outcomes. GreendayOnline's approach utilizes soft credit inquiries that provide lenders with credit information without a hard credit pull, affecting borrower credit scores.

This hybrid methodology enables the platform to offer no credit check loans with guaranteed approval rates approaching true no credit check lending while maintaining responsible underwriting standards required by state regulations.

Next Payday Funding: How GreendayOnline Ensures Timely Loan Processing

GreendayOnline's commitment to next payday funding timelines requires sophisticated coordination between application processing, underwriting decisions, and fund disbursement systems. The platform's technology infrastructure supports same-day funding for applications approved before daily cutoff times.

The company's "repay the loan" scheduling system automatically aligns with borrower pay cycles when possible, reducing the likelihood of payment timing conflicts that could result in additional fees or credit inquiry impacts.

About GreendayOnline

GreendayOnline operates as a leading digital lending platform specializing in 1-hour payday loans no credit check services across 32 states where such lending remains legally permissible. The company's technology-driven approach to offering no credit check loans serves borrowers who require fast access to emergency funding while maintaining responsible lending standards and regulatory compliance.

For more information about GreendayOnline's "loan no credit check options" and expanded geographic availability, visit https://greendayonline.com/ or contact the company's customer service team.

Media Contact:

Tarquin Nemec

GreendayOnline Public Relations Phone: (800) 424-2789

Email: tarquin.nemec@greendayonline.com

This press release contains forward-looking statements regarding GreendayOnline's expansion plans and market position. Actual results may differ from those projected. Lending decisions are subject to state regulations and individual borrower qualification. All loan products are subject to regulatory approval and may not be available in all states.

Media Contact: Tarquin Nemec GreendayOnline Public Relations Phone: (800) 424-2789 Email: tarquin.nemec@greendayonline.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.